Portfolio Carbon Initiative

The world is already transitioning to a low-carbon economy. Financial institutions have the power to expedite and smooth the transition by limiting their contribution to the climate problem and growing their contribution to the climate solution. The Portfolio Carbon Initiative, a partnership with Sustainable Finance Observatory (formerly 2 Degrees Investing Initiative) and UNEP Finance Initiative (UNEP FI), develops a series of resources to guide financial institutions in assessing the climate impact of their activities and carbon asset risk.

This initiative was previously called the Financed Emissions Initiative.

Portfolio Carbon Initiative Goals and Work Streams

Portfolio Carbon Initiative has two goals:

- Provide guidance on how to define, assess and track climate impact for asset owners and banks

- Provide guidance on how to identify, assess and manage carbon asset risks for financial institutions

The complexity of the financial sector requires that Portfolio Carbon Initiative operate via three work streams.

Work stream 1: Asset owner climate friendliness

Tailored to asset owners, this work stream produced a comparative analysis of current climate friendliness metrics, Climate Strategies and Metrics: Exploring Options for Institutional Investors.

Work stream 2: Bank climate friendliness

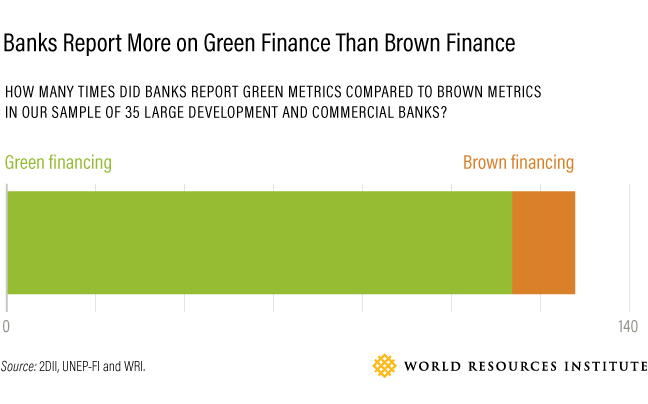

The working paper produced through this workstream, Exploring Metrics to Measure the Climate Progress of Banks, provides insight into which metrics public- and private-sector banks can use, depending on asset class, to report on the extent to which their activities help or harm the transition toward a low-carbon economy.

Work stream 3: Carbon asset risk

The guidance produced through this work stream, Carbon Asset Risk: Discussion Framework, explains why and when GHG emissions associated with carbon-intensive assets lead to financial risks, as well as how those risks can be assessed and managed.

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is