The World Is Counting on Banks to Deliver Climate Finance. Counting Their Progress Is No Easy Feat.

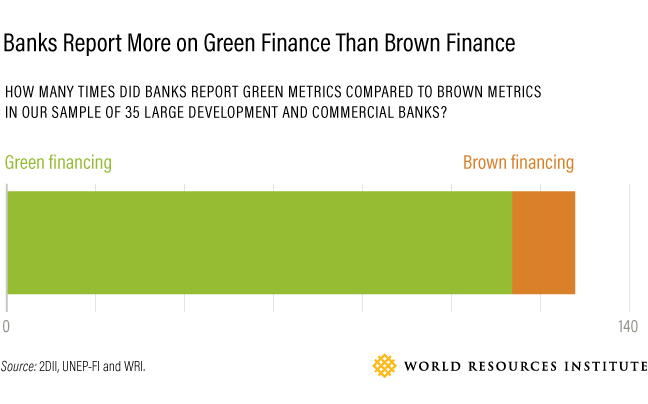

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is increasingly aware of the need to shift capital flows away from companies and activities that contribute to the climate problem and into climate solutions.

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is increasingly aware of the need to shift capital flows away from companies and activities that contribute to the climate problem and into climate solutions.

Scope 3 Calculation Guidance

An effective corporate climate change strategy requires a detailed understanding of a company’s greenhouse gas (GHG) emissions. Until recently, most companies have focused on measuring emissions from their own operations and electricity consumption, using the GHG Protocol’s scope 1 and scope 2 framework. But what about all of the emissions a company is responsible for outside of its own walls—from the goods it purchases to the disposal of the products it sells?

The Scope 3 Standard is the only internationally accepted method for companies to account for these types of value chain emissions. Building on this standard, GHG Protocol has now released a companion guide that makes it even easier for businesses to complete their scope 3 inventories.

New Guidance Makes Corporate Value Chain Accounting Easier

An effective corporate climate change strategy requires a detailed understanding of a company’s greenhouse gas (GHG) emissions. Until recently, most companies have focused on measuring emissions from their own operations and electricity consumption, using the GHG Protocol’s Scope 1 and Scope 2 framework.

Pagination

- Page 1

- Next page