Scope 3 Frequently Asked Questions

Disclaimer: These responses are meant to be helpful but are not intended to be the final word on how to interpret GHG Protocol standards. For the authoritative source, please refer to the relevant GHG Protocol standards. Neither WBCSD, WRI, nor other individuals who contributed to this response assume responsibility for any consequences or damages resulting directly or indirectly from its application in a specific use case.

Table of Contents

- How are scope 3 emissions organized?

- Is there guidance on conducting and interpreting a scope 3 screening exercise?

- How do GHG Protocol standards prevent double counting of emissions within a company's GHG inventory?

- How should companies address double counting of scope 3 emissions within a company's GHG inventory?

- What are the minimum and optional boundaries of each scope 3 category?

- What are the minimum boundaries for Category 15 (Investments)?

- Should I report emissions associated with equity investments in subsidiaries or join ventures in scope 3, Category 15?

- How do I account for emissions from teleworking?

- How should companies account emissions from intermediate products in a scope 3 inventory?

- Why is accounting for scope 3 emissions important?

- What are business goals for measuring and reporting scope 3 emissions?

- What are examples of actions I can take to reduce scope 3 emissions?

- How do I collect scope 3 emissions data?

- How do I prioritize scope 3 data collection efforts?

- What types of data can I use to calculate scope 3 emissions?

- How do I collect primary data from suppliers and other value chain partners?

- How can I fill data gaps and improve data quality over time?

- What resources does the GHG Protocol provide to help with scope 3 data collection and calculation?

- How can I account for scope 3 emissions and reductions over time?

- What about accounting for reductions outside of scope 3?

- How should companies manage data for scope 3 emissions reporting?

- What Global Warming Potential (GWP) values should companies use for GHG inventories?

- What are the Scope 3 Standard reporting requirements?

- What optional information should be included in a scope 3 inventory?

- What was the development process for the Scope 3 Standard?

- How does the GHG Protocol describe influence and its role in prioritizing scope 3 emissions reporting?

- Where can I find reliable sources for scope 3 emission factors?

- Can scope 2 market-based emissions data be applied to a scope 3 inventory?

- How is the project-based accounting method applied in the scope 3 reporting?

- What is the difference between inventory and project-based accounting?

- How should avoided emissions from the use of sold products be accounted for?

- Can carbon offsets be used to reduce a company's scope 3 emissions?

- How do a suppliers' carbon offsets impact my emissions reporting?

- How do I report emissions beyond minimum scope 3 boundaries?

1. How are scope 3 emissions organized?

The GHG Protocol Corporate Standard divides a company’s emissions into direct and indirect emissions.

- Direct emissions are emissions from sources that are owned or controlled by the reporting company.

- Indirect emissions are emissions that are a consequence of the activities of the reporting company but occur at sources owned or controlled by another company.

Emissions are further divided into three scopes (see table below). Direct emissions are included in scope 1. Indirect emissions are included in scope 2 and scope 3. While a company has control over its direct emissions, it has influence over its indirect emissions. A complete GHG inventory therefore includes scope 1, scope 2 and scope 3.

Overview of the scopes

| Emissions type | Scope | Definition | Examples |

| Direct emissions | Scope 1 | Emissions from operations that are owned or controlled by the reporting company | Emissions from combustion in owned or controlled boilers, furnaces, vehicles, etc.; emissions from chemical production in owned or controlled process equipment |

| Indirect emissions | Scope 2 | Emissions from the generation of purchased or acquired electricity, steam, heating, or cooling consumed by the reporting company | Use of purchased electricity, steam, heating, or cooling |

| Scope 3 | All indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions | Production of purchased products, transportation of purchased products, or use of sold products |

Source: Scope 3 Standard, Table 5.1 (Overview of the scopes), p. 28

The Scope 3 Standard categorizes scope 3 emissions into 15 distinct categories. The categories are intended to provide companies with a systematic framework to organize, understand and report on the diversity of scope 3 activities within a corporate value chain.

The categories are designed to be mutually exclusive, such that, for any one reporting company, there is no double counting of emissions between categories. Each scope 3 category is comprised of multiple scope 3 activities that individually result in emissions. Each category is described in detail in the Scope 3 Standard (Chapter 5).

The scope 3 categories are organized into upstream and downstream emissions. The distinction is based on the financial transactions of the reporting company:

- Upstream emissions are indirect GHG emissions related to purchased or acquired goods and services.

- Downstream emissions are indirect GHG emissions related to sold goods and services. Downstream emissions also include emissions from products that are distributed but not sold (i.e., without receiving payment). Finally, downstream emissions include emissions attributable to investments.

List of Scope 3 categories

| Upstream or downstream | Scope 3 category |

| Upstream scope 3 emissions |

|

| Downstream scope 3 emissions |

|

Source: Scope 3 Standard, Table 5.3 (List of Scope 3 categories), p. 32

2. Is there guidance on conducting and interpreting a scope 3 screening exercise?

Calculation methods for each scope 3 category that can be used for screening are provided in the Scope 3 Calculation Guidance. Refer to the Introduction of the Scope 3 Technical Guidance, particularly “Screening to prioritize data collection,” starting on p. 11, and the Scope 3 Standard, section 7.1. Further, refer to guidance on using environmentally-extended input-output (EEIO) data and proxy data on p. 17 and 18 of the Scope 3 Technical Guidance.

To summarize:

Companies may use a combination of approaches and criteria to identify priority activities. For example, companies may seek higher quality data for all activities that are significant in size, activities that present the most significant risks and opportunities in the value chain, and activities where more accurate data can be easily obtained. Companies may choose to rely on relatively less accurate data for activities that are expected to have insignificant emissions or where accurate data is difficult to obtain. (See Appendix C for guidance on developing a data management plan, including strategies for obtaining more accurate data over time).

The most rigorous approach to identifying priority activities is to use initial GHG estimation methods to determine which scope 3 activities are expected to be most significant in size. A quantitative approach gives the most accurate understanding of the relative magnitudes of various scope 3 activities. To prioritize activities based on their expected GHG emissions, companies should:

- use initial GHG estimation (or screening) methods to estimate the emissions from each scope 3 activity (e.g., by using industry-average data, environmentally-extended input output data (see box 7.1 in the Scope 3 Standard, p. 66), proxy data, or rough estimates); and

- rank all scope 3 activities from largest to smallest according to their estimated GHG emissions to determine which scope 3 activities have the most significant impact.

Companies may choose to prioritize scope 3 activities based on their relative financial significance or other criteria (Scope 3 Standard, p. 66), including activities that:

- the company has influence over;

- contribute to the company’s risk exposure;

- stakeholders deem critical;

- have been identified as significant by sector-specific guidance; or

- meet any additional criteria developed by the company or industry sector (Scope 3 Standard, Table 6.1, p. 61)

For more information and further reading:

- Scope 3 Standard, Chapter 7 (Collecting Data)

- Scope 3 Standard, Table 6.1 (Criteria for identifying relevant Scope 3 activities), p. 61

- Scope 3 Calculation Guidance “Screening to prioritize data collection,” starting on p. 11

3. How do GHG Protocol standards prevent double counting of emissions within a company's GHG inventory?

By properly accounting for emissions as scope 1, 2, or 3, and adhering to the GHG Protocol Scope 3 Standard, a company can ensure its emissions are recorded separately in different categories, avoiding double counting across scopes and scope 3 categories.

Scope 1, scope 2 and scope 3 are mutually exclusive for the reporting company, such that there is no double counting of emissions between the scopes. A company’s scope 3 inventory does not include any emissions already accounted for as scope 1 or scope 2 by the same company (Scope 3 Standard, p. 27). “If a company identifies any potential double counting of emissions between scope 3 categories or within a scope 3 category, the company should avoid double counting by only reporting scope 3 emissions from the activity once, clearly explaining where the emissions are reported, and providing cross-references, if needed” (Scope 3 Standard, footnote 3, p. 57). The scope 3 “categories are designed to be mutually exclusive, such that, for any one reporting company, there is no double counting of emissions between categories” (Scope 3 Standard, p. 31). Scope 3 Standard, p. 27). The scope 3 “categories are designed to be mutually exclusive, such that, for any one reporting company, there is no double counting of emissions between categories” (Scope 3 Standard, p. 31). “If a company identifies any potential double counting of emissions between scope 3 categories or within a scope 3 category, the company should avoid double counting by only reporting scope 3 emissions from the activity once, clearly explaining where the emissions are reported, and providing cross-references, if needed” (Scope 3 Standard, footnote 3, p. 57).

For more information and further reading:

- Scope 3 Standard, Chapter 5 (Identifying Scope 3 Emissions)

4. How should companies address double counting of scope 3 emissions and reductions across value chain partners?

Scope 3 emissions occur from sources owned or controlled by other entities in the value chain (e.g., materials suppliers, third-party logistics providers, waste management suppliers, etc.). As such, multiple entities may account for the same scope 3 emissions within the same value chain, typically in a different scope or scope 3 category.

For example: the scope 1 emissions of a power generator are the scope 2 emissions of an electrical appliance user, which are in turn the scope 3 emissions of both the appliance manufacturer and the appliance retailer. This type of overlap is a natural feature of a value chain. Moreover, each of these four companies has different and often mutually exclusive opportunities to reduce emissions. The appliance manufacturer can increase the efficiency of the appliance it produces. The product retailer can offer more energy-efficient product choices. And the electrical appliance user can use the appliance more efficiently, using less energy. Each entity, by accounting for value chain emissions, can plan and manage decarbonization activities accordingly. Scope 3 accounting facilitates the simultaneous action of multiple entities to reduce emissions throughout society. Because of this type of double counting, scope 3 emissions should not be aggregated across companies to determine total emissions in a given region.

Companies may find double counting of scope 3 emissions between companies’ GHG inventories to be acceptable for purposes of reporting scope 3 emissions to stakeholders, driving reductions in value chain emissions, and tracking progress toward each reporting company’s scope 3 reduction target. To ensure transparency and avoid misinterpretation of data, companies should acknowledge any potential double counting of reductions or credits when making claims about scope 3 reductions. For example, a company may claim that it is working jointly with partners to reduce emissions, for example, in cases where multiple value chain partners achieve scope 3 reductions by the same action taken by one or more entities, rather than taking exclusive credit for the scope 3 reduction(s) resulting from the actions of other entities in the value chain.

If GHG reductions take on a monetary value or receive credit via a GHG reduction program, companies should avoid double counting of credits from such reductions. To avoid double crediting, companies should specify exclusive ownership of reductions through contractual agreements (Scope 3 Standard, p. 108).

For more information and further reading:

- Scope 3 Standard, Chapter 5 (Identifying Scope 3 Emissions), p. 26-28

- Scope 3 Standard, section 9.6 (Addressing double counting of scope 3 reductions among multiple entities in a value chain), p. 108

5. What are the minimum and optional boundaries of each scope 3 category?

Table 5.4 in the Scope 3 Standard (p. 34), copied below, sets minimum boundaries for each category to standardize reporting. These boundaries help companies identify which activities' emissions must be included. Optional emissions are also noted for flexibility.

The minimum boundaries ensure significant activities are covered, without requiring companies to account for emissions endlessly across the value chain. Companies can include additional emissions beyond these boundaries where relevant or exclude emissions included in the minimum boundary, provided they clearly disclose and justify any exclusions (Scope 3 Standard, Chapter 6 (Setting the Scope 3 Boundary)).

Description and boundaries of scope 3 categories

| Category | Category description | Minimum boundary |

| 1. Purchased goods and services | Extraction, production, and transportation of goods and services purchased or acquired by the reporting company in the reporting year, not otherwise included in Categories 2 – 8 | All upstream (cradle-to-gate) emissions of purchased goods and services |

| 2. Capital goods | Extraction, production, and transportation of capital goods purchased or acquired by the reporting company in the reporting year | All upstream (cradle-to-gate) emissions of purchased capital goods |

| 3. Fuel- and energy-related activities (not included in scope 1 or scope 2) | Extraction, production, and transportation of fuels and energy purchased or acquired by the reporting company in the reporting year, not already accounted for in scope 1 or scope 2, including:

|

|

| 4. Upstream transportation and distribution | Transportation and distribution of products purchased by the reporting company in the reporting year between a company’s tier 1 suppliers and its own operations (in vehicles and facilities not owned or controlled by the reporting company) Transportation and distribution services purchased by the reporting company in the reporting year, including inbound logistics, outbound logistics (e.g., of sold products), and transportation and distribution between a company’s own facilities (in vehicles and facilities not owned or controlled by the reporting company) | The scope 1 and scope 2 emissions of transportation and distribution providers that occur during use of vehicles and facilities (e.g., from energy use) Optional: The life cycle emissions associated with manufacturing vehicles, facilities, or infrastructure |

| 5. Waste generated in operations | Disposal and treatment of waste generated in the reporting company’s operations in the reporting year (in facilities not owned or controlled by the reporting company | The scope 1 and scope 2 emissions of waste management suppliers that occur during disposal or treatment Optional: Emissions from transportation of waste |

| 6. Business travel | Transportation of employees for business-related activities during the reporting year (in vehicles not owned or operated by the reporting company) | The scope 1 and scope 2 emissions of transportation carriers that occur during use of vehicles (e.g., from energy use) Optional: The life cycle emissions associated with manufacturing vehicles or infrastructure |

| 7. Employee commuting | Transportation of employees between their homes and their worksites during the reporting year (in vehicles not owned or operated by the reporting company) | The scope 1 and scope 2 emissions of employees and transportation providers that occur during use of vehicles (e.g., from energy use) Optional: Emissions from employee teleworking |

| 8. Upstream leased assets | Operation of assets leased by the reporting company (lessee) in the reporting year and not included in scope 1 and scope 2 – reported by lessee | The scope 1 and scope 2 emissions of lessors that occur during the reporting company’s operation of leased assets (e.g., from energy use) Optional: The life cycle emissions associated with manufacturing or constructing leased assets |

| 9. Downstream transportation and distribution | Transportation and distribution of products sold by the reporting company in the reporting year between the reporting company’s operations and the end consumer (if not paid for by the reporting company), including retail and storage (in vehicles and facilities not owned or controlled by the reporting company) | The scope 1 and scope 2 emissions of transportation providers, distributors, and retailers that occur during use of vehicles and facilities (e.g., from energy use) Optional: The life cycle emissions associated with manufacturing vehicles, facilities, or infrastructure |

| 10. Processing of sold products | Processing of intermediate products sold in the reporting year by downstream companies (e.g., manufacturers) | The scope 1 and scope 2 emissions of downstream companies that occur during processing (e.g., from energy use) |

| 11. Use of sold products | End use of goods and services sold by the reporting company in the reporting year | The direct use-phase emissions of sold products over their expected lifetime (i.e., the scope 1 and scope 2 emissions of end users that occur from the use of: products that directly consume energy (fuels or electricity) during use; fuels and feedstocks; and GHGs and products that contain or form GHGs that are emitted during use) Optional: The indirect use-phase emissions of sold products over their expected lifetime (i.e., emissions from the use of products that indirectly consume energy (fuels or electricity) during use) |

| 12. End-of-life treatment of sold products | Waste disposal and treatment of products sold by the reporting company (in the reporting year) at the end of their life | The scope 1 and scope 2 emissions of waste management companies that occur during disposal or treatment of sold products |

| 13. Downstream leased assets | Operation of assets owned by the reporting company (lessor) and leased to other entities in the reporting year, not included in scope1 and scope 2 – reported by lessor | The scope 1 and scope 2 emissions of lessees that occur during operation of leased assets (e.g., from energy use). Optional: The life cycle emissions associated with manufacturing or constructing leased assets |

| 14. Franchises | Operation of franchises in the reporting year, not included in scope 1 and scope 2 – reported by franchisor | The scope 1 and scope 2 emissions of franchisees that occur during operation of franchises (e.g., from energy use) Optional: The life cycle emissions associated with manufacturing or constructing franchises |

| 15. Investments | Operation of investments (including equity and debt investments and project finance) in the reporting year, not included in scope 1 or scope 2 | See the description of category 15 (Investments) in section 5.5 for the required and optional boundaries |

Source: Scope 3 Standard, Table 5.4 (Description and boundaries of scope 3 categories), p. 34

For more information and further reading:

- Scope 3 Standard, “Minimum boundaries of scope 3 categories”, p. 31 and Table 5.4 (Description and boundaries of scope 3 categories), p. 34-37.

6. What are the minimum boundaries for Category 15 (Investments)?

The Scope 3 Standard divides financial investments into four types:

- Equity investments

- Debt investments

- Project finance

- Managed investments and client services

Table 5.9 and table 5.10 in the Scope 3 Standard provide GHG accounting guidance for each type of financial investment. Table 5.9 provides the types of investments included in the minimum boundary of category 15. Table 5.10 identifies types of investments that companies may optionally report, in addition to those provided in table 5.9.

The minimum boundary for Category 15 includes an investor’s proportional share of scope 1 and scope 2 emissions from investees, covering equity investments (using company capital and balance sheet), debt investments with known use of proceeds, and project finance. Scope 3 emissions of investees or projects should also be included when relevant (Scope 3 Standard, p. 51-54; Scope 3 Calculation Guidance, Table 15.1, p. 138).

Optional activities include debt investments without known use of proceeds, managed investments and client services, and other investments or financial services, which may be reported (Scope 3 Standard, p. 54).

For more information and further reading:

- Scope 3 Standard, Category 15 (Investments), p. 51-54

- Scope 3 Calculation Guidance, Chapter 15 (Investments), p. 136-152

7. Should I report emissions associated with equity investments in subsidiaries or joint ventures in scope 3 Category 15?

The selection of a consolidation approach affects which activities in the company’s value chain are categorized as direct emissions (i.e., scope 1 emissions) and indirect emissions (i.e., scope 2 and scope 3 emissions). Operations or activities that are excluded from a company’s scope 1 and scope 2 inventories as a result of the organizational boundary definition (e.g., leased assets, investments, and franchises) may become relevant when accounting for scope 3 emissions.

Scope 3 includes emissions from investments that are excluded from the company’s organizational boundary but that the company partially or wholly owns or controls. For example, if a company selects the equity share approach, emissions from any asset the company partially or wholly owns are included in its direct emissions (i.e., scope 1), but emissions from any asset the company controls but does not partially or wholly own (e.g., a leased asset) are excluded from its direct emissions and should be included in its scope 3 inventory.

Similarly, if a company selects the operational control approach, emissions from any asset the company controls are included in its direct emissions (i.e., scope 1), but emissions from any asset the company wholly or partially owns but does not control (e.g., investments) are excluded from its direct emissions and should be included in its scope 3 inventory (Scope 3 Standard, p. 28-29).

If emissions from equity investments are not included in scope 1 or scope 2 (because the reporting company uses either the operational control or financial control consolidation approach and does not have control over the investee), companies account for equity investments in scope 3, category 15 (Investments).

This includes equity investments in subsidiaries, associate companies, and joint ventures where partners have joint financial control. Refer to Table 5.9 (Scope 3 Standard, p. 52).

For reporting companies using the equity share consolidation approach, the scope 1 and scope 2 emissions of investees should be reported in the reporting company’s (investor’s) scope 1 and scope 2 emissions, respectively.

For more information and further reading:

- Scope 3 Standard, Category 15 (Investments), p. 51-54, Table 5.9 (Accounting for emissions from investments (required)), and Table 5.10 (Accounting for emissions from investments (optional))

- Scope 3 Calculation Guidance, Chapter 15 (Investments), p. 136

8. How do I account for emissions from teleworking?

Companies may include emissions from teleworking (i.e., employees working remotely) in category 7 (Employee commuting). This includes emissions associated with energy used in teleworking, i.e., by an employee at home or other location not owned or controlled by the reporting company (e.g., Btu of gas or kWh of electricity consumed).

To calculate these emissions, a baseline emissions scenario should first be established. Baseline emissions occur regardless of whether the employee was at home (e.g., energy consumed by the refrigerator). The reporting company should only account for the additional emissions resulting from working from home, for example the electricity usage as a result of running the air conditioner to stay cool.

For more information and further reading:

- Scope 3 Calculation Guidance , Chapter 7 (Category 7: Employee Commuting) and Calculation formula [7.1] (Distance-based method), p. 89

- Scope 3 Standard, Table [5.4] (Description and boundaries of scope 3 categories (continued)) on p. 34, section "Category 7: Employee commuting" on p. 46, and Table [9.7] (Illustrative examples of actions to reduce scope 3 emissions) on p. 110

9. How should companies account emissions from intermediate products in a scope 3 inventory?

Intermediate goods are “goods that are inputs to the production of other goods or services that require further processing, transformation, or inclusion in another product before use by the end consumer. Intermediate products are not consumed by the end user in their current form” (Scope 3 Standard, p. 39).

Section 5.6 “Applicability of downstream scope 3 categories to final and intermediate products” of the Scope 3 Standard provides guidance and states that: “The applicability of downstream scope 3 categories depends on whether products sold by the reporting company are final products or intermediate products. If a company produces an intermediate product (e.g., a motor), which becomes part of a final product (e.g., an automobile), the company accounts for downstream emissions associated with the intermediate product (the motor), not the final product (the automobile)” (p. 55).

According to Table 5.11 in the Scope 3 Standard (p. 56), companies should account for the following downstream emissions from intermediate products:

- Category 9: Downstream transportation and distribution of intermediate products

- Category 10: Processing of sold intermediate products by customers (e.g., manufacturers)

- Category 11: Direct use-phase emissions of sold intermediate products (i.e., emissions resulting from the use of sold intermediate products that directly consume fuel or electricity during use, fuels and feedstocks, and GHGs or products that contain GHGs that are released during use)

- Category 12: Emissions from disposing of sold intermediate products at the end of their life

If the final use of the intermediate product is unknown or has various potential downstream applications with different GHG profiles, companies may disclose and justify the exclusion of downstream emissions from these categories in their report. However, selective exclusion of specific categories is not permitted. (Scope 3 Standard, p. 60)

For more information and further reading:

- Scope 3 Standard, Chapter 5 (Identifying Scope 3 Emissions), including box 5.3 and section 5.6

- Scope 3 Standard, section 6.4

10. Why is accounting for scope 3 emissions important?

Scope 3 often represents the largest source of emissions for companies. It also presents the most significant opportunities to influence GHG reductions and achieve a variety of GHG-related business objectives (listed below). Developing a full corporate GHG emissions inventory – incorporating scope 1, scope 2, and scope 3 emissions – enables companies to understand their full emissions impact across the value chain and focus efforts where they can have the greatest impact.

The GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard, or Scope 3 Standard, published in 2011, is a supplement to the GHG Protocol Corporate Accounting and Reporting Standard, Revised Edition (2004). The Scope 3 Standard builds upon the Corporate Standard to promote additional completeness and consistency in the way companies account for and report on indirect emissions from value chain activities through additional requirements and guidance for scope 3 accounting and reporting.1

Scope 3 can represent over 90% of a company’s scope 1, 2 and 3 emissions. Scope 3 includes many of companies’ most significant impacts, such as emissions in the supply chain from producing the materials a company purchases (e.g. from outsourced manufacturing) and the emissions from the products the company makes and sells (e.g. emissions from cars produced and sold by automakers).

A company’s impacts, risks and opportunities related to GHG emissions and climate change depends on their upstream and downstream impacts, not only their direct operations. A complete GHG inventory across scope 1, scope 2 and scope 3 is needed to enable companies to understand and manage climate-related impacts, risks and opportunities. Scope 3 emissions have significant opportunities for strategic engagement and management for companies to make key decisions or influence choices concerning the selection of suppliers and other value chain partners, material inputs, investments, and product types and design.

Scope 3 emissions reporting is increasingly commonplace, as shown by thousands of companies reporting to reporting platforms such as CDP and participating in the Science-Based Targets initiative. As an example, over 1,100 companies have approved science-based targets as part of SBTi and all of these companies completed and submitted a full scope 3 inventory for their validation.

For more information and further reading:

- What Are Greenhouse Gas Accounting and Corporate Climate Disclosures? 6 Questions, Answered, GHG Protocol, March, 2024

11. What are business goals for measuring and reporting scope 3 emissions?

Developing a scope 3 inventory strengthens companies’ understanding of their value chain GHG emissions as a step towards effectively managing emissions-related risks and opportunities and reducing value chain GHG emissions.67

Business goals served by a scope 3 GHG inventory

| Business goal | Description |

| Identify and understand risks and opportunities associated with value chain emissions |

|

| Identify GHG reduction opportunities, set reduction targets, and track performance |

|

| Engage value chain partners in GHG management |

|

| Enhance stakeholder information and corporate reputation through public reporting |

|

Source: Scope 3 Standard, Table 2.1 (Business goals served by a scope 3 GHG inventory), p. 12

Examples of GHG-related risks and opportunities related to scope 3 emissions

| Type of risk | Examples |

| Regulatory | GHG emissions-reduction laws or regulations introduced or pending in regions where the company, its suppliers, or its customers operate |

| Supply chain costs and reliability | Suppliers passing higher energy- or emissions-related costs to customers; supply chain business interruption risk |

| Product and technology | Decreased demand for products with relatively high GHG emissions; increased demand for competitors’ products with lower emissions |

| Litigation | GHG-related lawsuits directed at the company or an entity in the value chain |

| Reputation | Consumer backlash, stakeholder backlash, or negative media coverage about a company, its activities, or entities in the value chain based on GHG management practices, emissions in the value chain, etc. |

| Type of Opportunity | Examples |

| Efficiency and cost savings | A reduction in GHG emissions often corresponds to decreased costs and an increase in companies’ operational efficiency. |

| Drive innovation | A comprehensive approach to GHG management provides new incentives for innovation in supply chain management and product design. |

| Increase sales and customer loyalty | Low-emissions goods and services are increasingly more valuable to consumers, and demand will continue to grow for new products that demonstrably reduce emissions throughout the value chain. |

| Improve stakeholder relations | Improve stakeholder relationships through proactive disclosure and demonstration of environmental stewardship. Examples include demonstrating fiduciary responsibility to shareholders, informing regulators, building trust in the community, improving relationships with customers and suppliers, and increasing employee morale. |

| Company differentiation | External parties (e.g. customers, investors, regulators, shareholders, and others) are increasingly interested in documented emissions reductions. A scope 3 inventory is a best practice that can differentiate companies in an increasingly environmentally-conscious marketplace. |

Source: Scope 3 Standard, Table 2.2 (Examples of GHG-related risks and opportunities related to scope 3 emissions), p. 13

12. What are examples of actions I can take to reduce scope 3 emissions?

Companies may implement a variety of actions to reduce scope 3 emissions. Table 9.7 provides an illustrative list of actions that companies can take to reduce emissions in the value chain.

Illustrative examples of actions to reduce scope 3 emissions

Upstream scope 3 emissions

| Category | Examples of actions to reduce scope 3 emissions |

| 1. Purchased goods and services |

|

| 2. Capital goods |

|

| 3. Fuel- and energy- related activities (not included in scope 1 or scope 2) |

|

| 4. Upstream transportation and distribution |

|

| 5. Waste generated in operations |

|

| 6. Business travel |

|

| 7. Employee commuting |

|

| 8. Upstream leased assets |

|

Downstream scope 3 emissions

| Category | Examples of actions to reduce scope 3 emissions |

| 9. Transportation and distribution of sold products |

|

| 10. Processing of sold products |

|

| 11. Use of sold products |

|

| 12. End-of-life treatment of sold products |

|

| 13. Downstream leased assets |

|

| 14. Franchises |

|

| 15. Investments |

|

Source: Scope 3 Standard, Table 9.7 (Illustrative examples of actions to reduce scope 3 emissions), p. 110 - 111

13. How do I collect scope 3 emissions data?

Collecting scope 3 emissions data is likely to require wider engagement within the reporting company, as well as with suppliers and partners outside of the company, than is needed to collect scope 1 and scope 2 emissions data. Companies may need to engage several internal departments, such as procurement, energy, manufacturing, marketing, research and development, product design, logistics, and accounting.

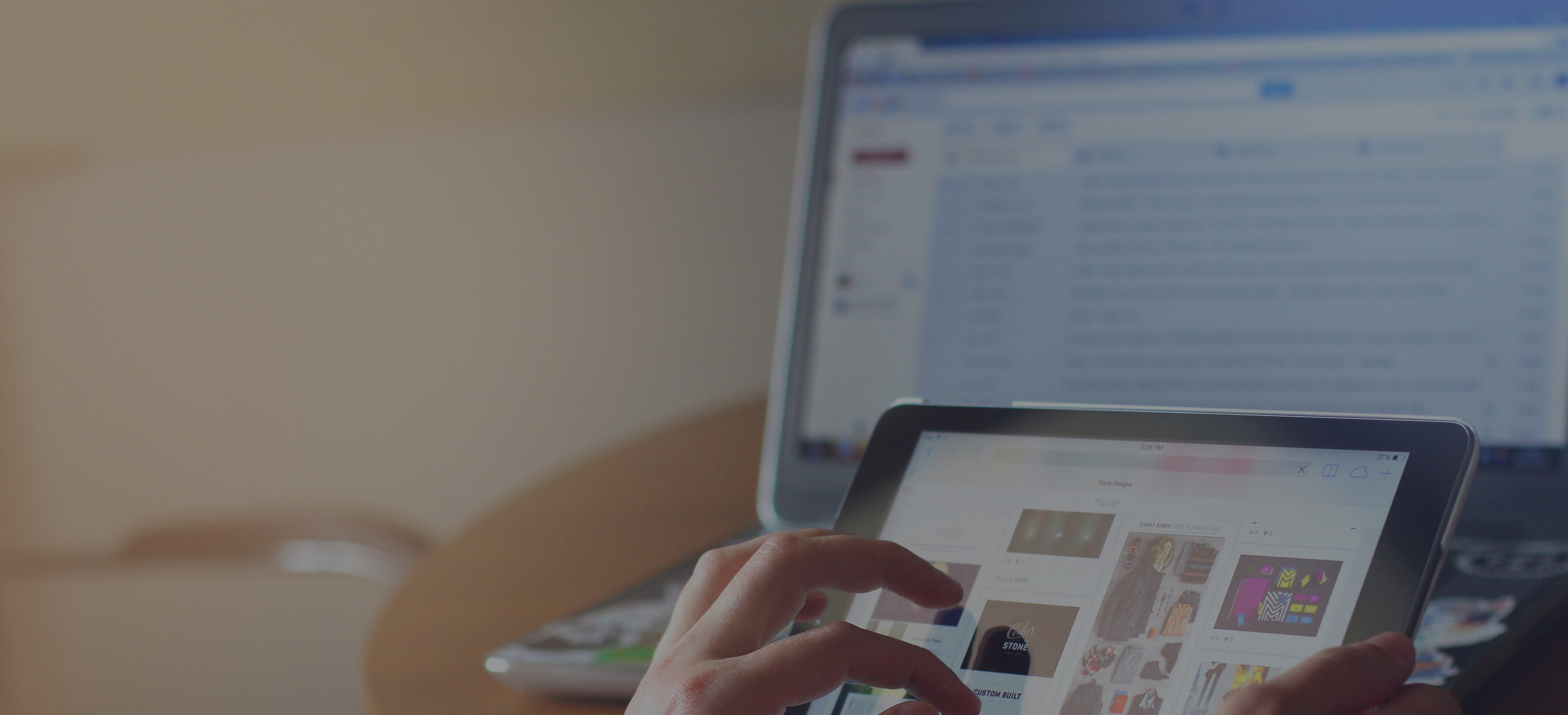

Chapter 7 of the Scope 3 Standard provides a four-step approach to collecting and evaluating data (see figure 7.1).

For more information/further reading:

- Scope 3 Standard, Chapter 7 (Collecting Data)

14. How do I prioritize scope 3 data collection efforts?

Companies should prioritize data collection efforts on the scope 3 activities that are expected to have the most significant GHG emissions, offer the most significant GHG reduction opportunities, and are most relevant to the company’s business goals. Collecting higher quality data for priority activities allows companies to focus resources on the most significant GHG emissions in the value chain, more effectively set reduction targets, and track and demonstrate GHG reductions over time (covered in chapter 9 of the Scope 3 Standard).

Companies may use a combination of approaches and criteria to identify priority activities. For example, companies may seek higher quality data for all activities that are significant in size, activities that present the most significant risks and opportunities in the value chain, and activities where more accurate data can be easily obtained (Scope 3 Standard, p. 65-66). Companies may choose to rely on relatively less accurate data for activities that are expected to have insignificant emissions or where accurate data is difficult to obtain.

Prioritizing activities based on the magnitude of GHG emissions

The most rigorous approach to identifying priority activities is to use initial GHG estimation (or screening) methods to determine which scope 3 activities are expected to be most significant in size. A quantitative approach gives the most accurate understanding of the relative magnitudes of various scope 3 activities. To prioritize activities based on their expected GHG emissions, companies should:

- use initial GHG estimation (or screening) methods to estimate the emissions from each scope 3 activity (e.g., by using industry-average data, environmentally-extended input output data, proxy data, or rough estimates); and

- rank all scope 3 activities from largest to smallest according to their estimated GHG emissions to determine which scope 3 activities have the most significant impact.

Calculation methods for each scope 3 category that can be used for screening are provided in a separate document, Technical Guidance for Calculating Scope 3 Emissions.

Prioritizing activities based on financial spend or revenue

As an alternative to ranking scope 3 activities based on their estimated GHG emissions, companies may choose to prioritize scope 3 activities based on their relative financial significance. Companies may use a financial spend analysis to rank upstream types of purchased products by their contribution to the company’s total spend or expenditure (for an example, see the AkzoNobel case study, p.67). For downstream emissions, companies may likewise rank types of sold products by their contribution to the company’s total revenue.

Companies should use caution in prioritizing activities based on financial contribution, because spend and revenue may not correlate well with emissions. For example, some activities have a high market value but have relatively low emissions. Conversely, some activities have a low market value but have relatively high emissions. As a result, companies should also prioritize activities that do not contribute significantly to financial spend or revenue but are expected to have a significant GHG impact.

Prioritizing activities based on other criteria

In addition to prioritizing data collection efforts on activities expected to contribute significantly to total scope 3 emissions or to spend, companies may prioritize any other activities expected to be most relevant for the company or its stakeholders, including activities that:

- the company has influence over;

- contribute to the company’s risk exposure;

- stakeholders deem critical;

- have been identified as significant by sector-specific guidance; or

- meet any additional criteria developed by the company or industry sector (Scope 3 Standard, Chapter 6, Table 6.1 (Criteria for identifying relevant scope 3 activities), p. 61).

To prioritize scope 3 activities, companies may also assess whether any GHG- or energy-intensive materials or activities appear in the value chain of purchased and sold products.

For more information/further reading:

- Scope 3 Standard, Chapter 7 (Collecting Data)

- Scope 3 Standard, AkzoNobel case study, p. 67

15. What types of data can I use to calculate scope 3 emissions?

Companies may use two types of data to calculate scope 3 emissions:

- Primary data: Data from specific activities within a company’s value chain

- Secondary data: Data that is not from specific activities within a company’s value chain

Primary data includes data provided by suppliers or other value chain partners related to specific activities in the reporting company’s value chain. Such data may take the form of primary activity data, or emissions data calculated by suppliers that are specific to suppliers’ activities.

Secondary data includes industry-average data (e.g., from published databases, government statistics, literature studies, and industry associations), financial data, proxy data, and other generic data. In certain cases, companies may use specific data from one activity in the value chain to estimate emissions for another activity in the value chain. This type of data (i.e., proxy data) is considered secondary data, since it is not specific to the activity whose emissions are being calculated.

The quality of the scope 3 inventory depends on the quality of the data used to calculate emissions. Companies should collect data of sufficient quality to ensure that the inventory appropriately reflects the GHG emissions of the company, supports the company’s goals, and serves the decision-making needs of users, both internal and external to the company. After prioritizing scope 3 activities, companies should select data based on the following:

- The company’s business goals

- The relative significance of scope 3 activities

- The availability of primary and secondary data

- The quality of available data

In general, companies should collect high quality, primary data for high priority activities. To most effectively track performance, companies should use primary data collected from suppliers and other value chain partners for scope 3 activities targeted for achieving GHG reductions.

In some cases, primary data may not be available or may not be of sufficient quality. In such cases, secondary data may be of higher quality than the available primary data for a given activity. Data selection depends on business goals. If the company’s main goal is to set GHG reduction targets, track performance from specific operations within the value chain, or engage suppliers, the company should select primary data. If the company’s main goal is to understand the relative magnitude of various scope 3 activities, identify hot spots, and prioritize efforts in primary data collection, the company should select secondary data. In general, companies should collect secondary data for:

- Activities not prioritized based on initial estimation methods or other criteria

- Activities for which primary data is not available (e.g., where a value chain partner is unable to provide data)

- Activities for which the quality of secondary data is higher than primary data (e.g., when a value chain partner is unable to provide data of sufficient quality)

Companies are required to report a description of the types and sources of data (including activity data, emission factors, and GWP values) used to calculate emissions, and the percentage of emissions calculated using data obtained from suppliers or other value chain partners (covered in chapter 11 of the Scope 3 Standard).

See table 7.5 for a list of advantages and disadvantages of primary data and secondary data.

| Primary data (e.g., supplier-specific data) | Secondary data (e.g., industry-average data) | |

| Advantages |

|

|

| Disadvantages |

|

|

Source: Scope 3 Standard, Table 7.5 (Advantages and disadvantages of primary data and secondary data), p. 74

Data quality

Sources of primary data and secondary data can vary in quality. When selecting data sources, companies should use the data quality indicators provided in the Scope 3 Standard as a guide to obtaining the highest quality data available for a given emissions activity. The data quality indicators describe the representativeness of data (in terms of technology, time, and geography) and the quality of data measurements (i.e., completeness and reliability of data).

Companies should select data that are the most representative in terms of technology, time, and geography; most complete; and most reliable. To ensure transparency and avoid misinterpretation of data, companies are required to report a description of the data quality of reported emissions data covered in chapter 11 of the Scope 3 Standard).

For more information and further reading:

- Scope 3 Standard, Chapter 7 (Collecting Data)

- Scope 3 Standard, Chapter 10, Assurance

- Scope 3 Standard, Appendix C, Data Management Plan

- IPCC Global Warming Potential Values

16. How do I collect primary data from suppliers and other value chain partners?

Primary activity data may be obtained through meter readings, purchase records, utility bills, engineering models, direct monitoring, mass balance, stoichiometry, or other methods for obtaining data from specific activities in the company’s value chain.

Where possible, companies should collect energy or emissions data from suppliers and other value chain partners to obtain site-specific data for priority scope 3 categories and activities. To do so, companies should identify relevant suppliers from which to seek GHG data. Suppliers may include contract manufacturers, materials and parts suppliers, capital equipment suppliers, fuel suppliers, third party logistics providers, waste management companies, and other companies that provide goods and services to the reporting company.

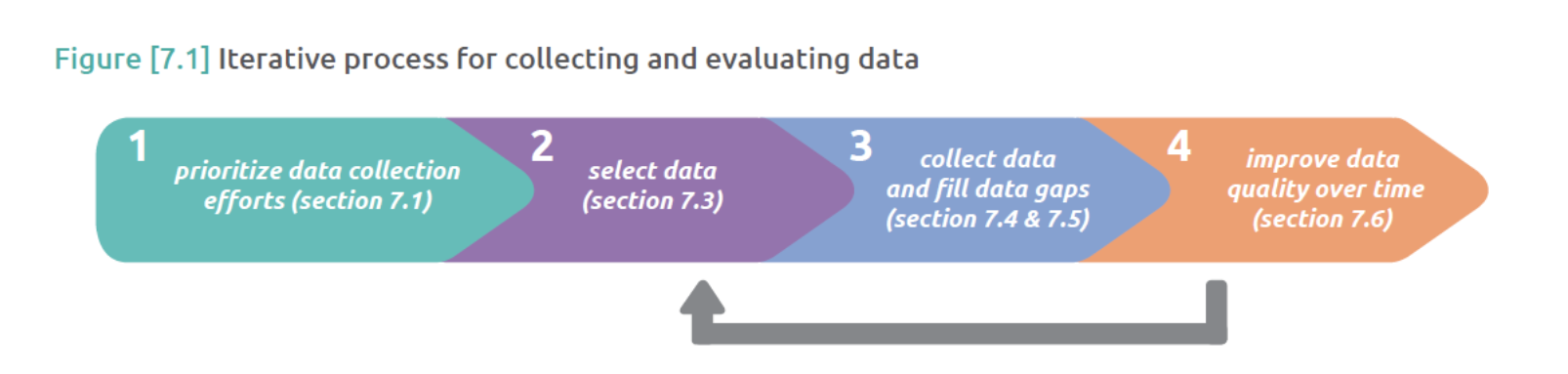

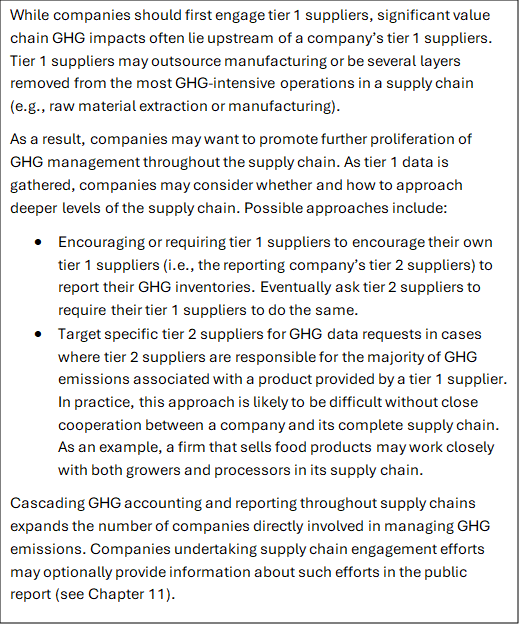

Companies should first engage relevant tier 1 suppliers (Scope 3 Standard, Figure 7.3 (Iterative process for collecting and evaluating data), p. 65). Tier 1 suppliers are companies with which the reporting company has a purchase order for goods or services (e.g., materials, parts, components, etc.). Tier 1 suppliers have contractual obligations with the reporting company, providing the leverage needed to request GHG inventory data.

To be comprehensive, companies may seek to obtain GHG emissions data from all tier 1 suppliers. However, a company may have many small tier 1 suppliers that together comprise only a small share of a company’s total activities and spending. Companies may develop their own policy for selecting relevant suppliers to target for primary data collection. For example, a company may select suppliers based on their contribution to its total spend (Scope 3 Standard, Box 7.3, p.80). A company may also seek data from tier 2 suppliers, where relevant (see box Scope 3 Standard, Box 7.5, p. 83). Tier 2 suppliers are companies with which tier 1 suppliers have a purchase order for goods and services (Scope 3 Standard, Figure 7.3, p. 78). Companies should use secondary data to calculate emissions from activities where supplier-specific data is not collected or is incomplete.

Companies are required to report the percentage of emissions calculated using data obtained from suppliers or other value chain partners (covered in Chapter 11 of the Scope 3 Standard).

Not all of a company’s relevant suppliers may be able to provide GHG inventory data to the company. (See Table 7.8 (p.82) for a list of challenges and guidance for collecting primary data from suppliers.) In such cases, companies should encourage suppliers to develop GHG inventories in the future and may communicate their efforts to encourage more suppliers to provide GHG emissions data in the public report.

Source: Scope 3 Standard, Figure [7.3] Tier 1 suppliers in a supply chain, p. 78

Box: Expanding supplier GHG management beyond tier 1 suppliers

Source: Scope 3 Standard, Box [7.5] Expanding supplier GHG management beyond tier 1 suppliers, p. 83

Challenges and guidance for collecting primary data from value chain partners

| Challenges | Guidance |

| Large number of suppliers |

|

| Lack of supplier knowledge and experience with GHG inventories and accounting |

|

| Lack of supplier capacity and resources for tracking data |

|

| Lack of transparency in the quality of supplier data |

|

| Confidentiality concerns of suppliers |

|

| Language barriers |

|

Source: Scope 3 Standard, Table [7.8] Challenges and guidance for collecting primary data from value chain partners, p. 82

For more information and further reading:

- Scope 3 Standard, Chapter 7 (Collecting Data)

- GHG Protocol Supplier Engagement Guidance

17. How can I fill data gaps and improve data quality over time?

Companies can use secondary data to fill data gaps. When using secondary databases, companies should prioritize databases and publications that are internationally recognized, provided by national governments, or peer-reviewed. Companies should use the data-quality indicators when selecting secondary data sources. The data-quality indicators should be used to select secondary data that are the most representative to the company’s activities in terms of technology, time, and geography, and that are the most complete and reliable.

If data of sufficient quality is not available, companies may use proxy data to fill data gaps. Proxy data is data from a similar activity that is used as a stand-in for the given activity. Proxy data can be extrapolated, scaled up, or customized to be more representative of the given activity (e.g., partial data for an activity that is extrapolated or scaled up to represent 100 percent of the activity).

For secondary data, section 7.5 of the Scope 3 Standard provides guidance on using proxy data to fill data gaps and provides examples of proxy data.

Collecting data, assessing data quality, and improving data quality is an iterative process. Companies should first apply data quality indicators and assess data quality when selecting data sources, then review the quality of data used in the inventory after data has been collected, using the same data quality assessment approach. In the initial years of scope 3 data collection, companies may need to use data of relatively low quality due to limited data availability. Over time, companies should seek to improve the data quality of the inventory by replacing lower quality data with higher quality data as it becomes available. In particular, companies should prioritize data quality improvement for activities that have the following:

- Relatively low data quality

- Relatively high emissions

Companies are required to provide a description of the data quality of reported scope 3 emissions data to ensure transparency and avoid misinterpretation of data.

For more information and further reading

- Scope 3 Standard, Chapter 7 (Collecting Data)

- Section 7.6 “Improving data quality over time,” p.84

- Section 7.3 “Guidance for selecting data,” p. 74-77

- Section 7.5, Guidance for collecting secondary data and filling data gaps, p. 83

- Scope 3 Standard, section 9.3, “Recalculating base year emissions” p.104-106

- Scope 3 Standard, Appendix B (Uncertainty in Scope 3 Emissions), p. 126-128

- Scope 3 Standard, Appendix C (Data Management Plan), p. 129-133

- Scope 3 Technical Guidance, Introduction, p. 16-18

18. What resources does the GHG Protocol provide to help with scope 3 data collection and calculation?

The following resources are available at https://ghgprotocol.org/standards/scope-3-standard:

- Technical Guidance for Calculating Scope 3 Emissions (for each scope 3 category)

- Supplier Engagement Guidance

- Third party life cycle databases

- Scope 3 online training (e-learning) course

19. How can I account for scope 3 emissions and reductions over time?

Reductions in corporate emissions are calculated by comparing changes in the company’s actual emissions inventory over time relative to a base year. The inventory method allows companies to track the aggregate effect of their activities on total corporate GHG emissions over time.

Accounting for actual reductions in indirect emissions (i.e., scope 2 or scope 3 emissions) to the atmosphere is more complex than accounting for actual reductions in direct emissions (i.e., scope 1) to the atmosphere. Changes in a company’s scope 2 or scope 3 inventory over time may not always correspond to actual changes in GHG emissions to the atmosphere, since there is not always a direct cause-and-effect relationship between the reporting company’s activities and the resulting GHG emissions. For example, a reduction in business travel would reduce a company’s scope 3 emissions from business travel (since the reduction is usually quantified based on an average emission factor of fuel use per passenger). However, how a reduction in business travel actually translates into a change in GHG emissions to the atmosphere depends on several factors, including whether another person takes the “empty seat” or whether the unused seat contributes to reduced air traffic over the longer term. Generally, as long as the accounting of scope 3 emissions over time recognizes activities that in aggregate change global emissions, any such concerns should not inhibit companies from reporting and tracking their scope 3 emissions over time.

Companies may use the project accounting method to undertake more detailed assessments of actual reductions from discrete scope 3 GHG mitigation projects, in addition to reporting comprehensive scope 3 GHG emissions using the inventory method. Any project-based reductions must be reported separately from the company’s scope 1, scope 2, and scope 3 emissions.

For more information and further reading:

- Scope 3 Standard, Chapter 9 (Setting a GHG Reduction Target and Tracking Emissions Over Time), section 9.4 (Accounting for scope 3 emissions and reductions over time), p. 106-107

- Scope 3 Calculation Guidance

- For more information on quantifying project-based GHG reductions, refer to the Project Protocol

20. What about accounting for reductions outside of scope 3?

The Scope 3 standard is intended to assist companies in quantifying and reporting scope 3 reductions, where GHG reductions are determined by comparing changes in the company’s scope 3 emissions from the fifteen scope 3 categories over time relative to a base year. In some cases, GHG reduction opportunities lie beyond a company’s scope 1, scope 2, and scope 3 inventories. For example, some companies may track not only the emissions that arise from the use of their products (category 11), but also the avoided emissions in society that result from the use of their products and solutions compared to alternative products and solutions. Avoided emissions may also arise when accounting for emissions from recycling (category 5 or 13), or from activities in other scope 3 categories.

Accounting for avoided emissions that occur outside of a company’s scope 1, scope 2, and scope 3 inventories requires a project accounting methodology. Any estimates of avoided emissions must be reported separately from a company’s scope 1, scope 2, and scope 3 emissions, rather than included or deducted from the scope 3 inventory.

Accounting for avoided emissions from the use of sold products

To reduce scope 3 emissions from the use of sold products (category 11), companies may implement various GHG reduction strategies, such as redesigning products to be more efficient in the use-phase or replacing existing product lines with new zero-emitting product lines. These reduction activities can be tracked by comparing a company’s scope 3 emissions inventory over time.

A company’s products can also have broader impacts on GHG emissions in society when they provide the same or similar function as existing products in the marketplace but with significantly less GHG emissions. For example, a manufacturer of renewable energy technologies may be interested not only in tracking the emissions and reductions that occur during the use of its products, but also in assessing the reduction in society’s GHG emissions as a result of using renewable energy technologies compared to generating electricity by combusting fossil fuels.

Examples of such products and solutions may include:

- Wind turbines or solar panels, compared to fossil fuel power plants

- LED bulbs, compared to incandescent bulbs

- Triple-pane windows, compared to double- or single-pane windows

- Insulation in a building, compared to no insulation

- Online meeting software, compared to business travel

Developing new products and solutions that achieve GHG reductions in society compared to other products and solutions is an important component of corporate sustainability strategies and offers significant opportunities for achieving large scale GHG reductions. These reductions are accounted for in scope 3 emissions to the extent that they decrease a company’s emissions from the use of sold products over time, for example by redesigning products or replacing existing product lines with new product lines.

Avoided emissions from the use of sold products compared to a baseline are not included in a company’s scope 3 emissions. Accounting for such reductions requires a project-based accounting methodology and poses several accounting challenges to ensure that reduction claims are accurate and credible. Challenges include how to:

- Determine an appropriate baseline scenario (e.g., which technologies to compare)

- Determine the system boundaries (e.g., which emissions to include)

- Determine the time period (e.g., how many years to include)

- Accurately quantify avoided emissions

- Avoid “cherry picking” (e.g., account for both emissions increases and decreases across the company’s entire product portfolio)

- Allocate reductions among multiple entities in a value chain (e.g., avoid double counting of reductions between producers of intermediate goods, producers of final goods, retailers, etc.)

If a company chooses to account for avoided emissions from the use of sold products, avoided emissions are not included in or deducted from the scope 3 inventory, but instead reported separately from scope 1, scope 2, and scope 3 emissions. Companies that report avoided emissions should also report the methodology and data sources used to calculate avoided emissions, the system boundaries, the time period considered, the baseline (and baseline assumptions) used to make the comparison, as well as a statement on completeness (avoiding “cherry picking”) and ownership (avoiding double counting of reductions).

For more information on quantifying project-based GHG reductions, refer to the Project Protocol.

For more information on avoided emissions, see the Estimating and Reporting Avoided Emissions.

21. How should companies manage data for scope 3 emissions reporting?

A data management plan documents the GHG inventory process and the internal quality assurance and quality control (QA/QC) procedures in place to enable the preparation of the inventory from its inception through to final reporting. A data management plan is a valuable tool to manage data and track progress of the inventory over time. Appendix C (Data Management Plan) of the Scope 3 Standard (p. 129-133) provides guidance on developing a data management plan.

22. What Global Warming Potential (GWP) values should companies use for GHG inventories?

The 2013 amendment to the Corporate Standard on Required Greenhouse Gases in Inventories states that companies shall use GWP values provided by the Intergovernmental Panel on Climate Change (IPCC) based on a 100-year time horizon. These values should be applied consistently across Scope 1, Scope 2, and Scope 3 inventories (Scope 3 Standard, p. 70). Companies may also report emissions using 20-year GWP values separately, where relevant.

The amendment further recommends that companies should use GWP values from the most recent IPCC Assessment Report (AR). The IPCC's 6th Assessment Report (AR6), published in 2020, is the most recent. AR6 GWP values are provided in the link below.

Companies shall use GWP values from a single AR for any one inventory, where possible. Companies should use the same GWP values for the current inventory period and the base year to maintain consistency and comparability across time and scopes.

For more information and further reading:

- Required Greenhouse Gases in Inventories, Accounting and Reporting Standard Amendment, February, 2013

- IPCC Global Warming Potential Values, August, 2024

23. What are the Scope 3 Standard reporting requirements?

Chapter 11, section 11.1, Required information, in the Scope 3 Standard details the reporting requirements. Companies “shall” publicly report the following information:

- A scope 1 and scope 2 emissions report in conformance with the GHG Protocol Corporate Standard

- Total scope 3 emissions reported separately by scope 3 category

- For each scope 3 category, total emissions of GHGs (carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorochemicals (PFCs), sulfur hexafluoride (SF6), and nitrogen trifluoride (NF3) reported in metric tons of CO2 equivalent, excluding biogenic CO2 emissions and independent of any GHG trades, such as purchases, sales, or transfers of offsets or allowances

- A list of scope 3 categories and activities included in the inventory

- A list of scope 3 categories or activities excluded from the inventory with justification of their exclusion

- Once a base year has been established: the year chosen as the scope 3 base year; the rationale for choosing the base year; the base year emissions recalculation policy; scope 3 emissions by category in the base year, consistent with the base year emissions recalculation policy; and appropriate context for any significant emissions changes that triggered base year emissions recalculations

- For each scope 3 category, any biogenic CO2 emissions reported separately

- For each scope 3 category, a description of the types and sources of data, including activity data, emission factors and GWP values, used to calculate emissions, and a description of the data quality of reported emissions data

- For each scope 3 category, a description of the methodologies, allocation methods, and assumptions used to calculate scope 3 emissions

- For each scope 3 category, the percentage of emissions calculated using data obtained from suppliers or other value chain partners

Section 11.2, Optional information, provides a list of additional reporting elements that companies “should include,” where applicable.

For more information and further reading:

- Scope 3 Standard, Chapter 11 (Reporting)

24. What optional information should be included in a scope 3 inventory?

The following information is listed in Section 11.2, Optional information, in the Scope 3 Standard. A public GHG emissions report should include, when applicable, the following additional information:

- Emissions data further subdivided where this adds relevance and transparency (e.g., by business unit, facility, country, source type, activity type, etc.)

- Emissions data further disaggregated within scope 3 categories where this adds relevance and transparency (e.g., reporting by different types of purchased materials within category 1, or different types of sold products within category 11)

- Emissions from scope 3 activities not included in the list of scope 3 categories (e.g., transportation of attendees to conferences/events), reported separately (e.g., in an “other” scope 3 category)

- Emissions of GHGs reported in metric tons of each individual gas

- Emissions of any GHGs other than CO2, CH4, N2O, HFCs, PFCs, and SF6 whose 100-year GWP values have been identified by the IPCC to the extent they are emitted in the company’s value chain (e.g., CFCs, HCFCs, NF3, NOX, etc.) and a list of any additional GHGs included in the inventory

- Historic scope 3 emissions that have previously occurred, reported separately from future scope 3 emissions expected to occur as a result of the reporting company’s activities in the reporting year (e.g., from Waste generated in operations, Use of sold products, End-of-life treatment of sold products)

- Qualitative information about emission sources not quantified

- Information on any GHG sequestration or removals, reported separately from scope 1, scope 2 and scope 3 emissions

- Information on project-based GHG reductions calculated using the project method (e.g., using the GHG Protocol for Project Accounting), reported separately from scope 1, scope 2, and scope 3 emissions

- Information on avoided emissions (e.g., from the use of sold products), reported separately from scope 1, scope 2, and scope 3 emissions

- Quantitative assessments of data quality

- Information on inventory uncertainty (e.g., information on the causes and magnitude of uncertainties in emission estimates) and an outline of policies in place to improve inventory quality

- The type of assurance performed (first or third party), the relevant competencies of the assurance provider(s), and the opinion issued by the assurance provider

- Relevant performance indicators and intensity ratios

- Information on the company’s GHG management and reduction activities, including scope 3 reduction targets, supplier engagement strategies, product GHG reduction initiatives, etc.

- Information on supplier/partner engagement and performance

- Information on product performance

- A description of performance measured against internal and external benchmarks

- Information on purchases of GHG reduction instruments, such as emissions allowances and offsets, from outside the inventory boundary

- Information on reductions at sources inside the inventory boundary that have been sold/transferred as offsets to a third party

- Information on any contractual provisions addressing GHG-related risks or obligations

- Information on the causes of emissions changes that did not trigger a scope 3 base year emissions recalculation

- GHG emissions data for all years between the scope 3 base year and the reporting year (including details of and reasons for recalculations, if appropriate)

- Additional explanations to provide context to the data

For more information and further reading:

- Scope 3 Standard, Chapter 11 (Reporting)

25. What was the development process for the Scope 3 Standard?

The standards development process is a defining feature of the GHG Protocol. The GHG Protocol follows a broad and inclusive multi-stakeholder process to develop greenhouse gas accounting and reporting standards with participation from businesses, government agencies, NGOs, and academic institutions from around the world.

In 2008, WRI and WBCSD launched a three-year process to develop the GHG Protocol Scope 3 Standard. A 25-member Steering Committee of experts provided strategic direction throughout the process. The first draft of the Scope 3 Standard was developed in 2009 by Technical Working Groups consisting of 96 members (representing diverse industries, government agencies, academic institutions, and non-profit organizations worldwide). In 2010, 34 companies from a variety of industry sectors road-tested the first draft and provided feedback on its practicality and usability, which informed a second draft. Members of a Stakeholder Advisory Group (consisting of more than 1,600 participants) provided feedback on each draft of the standard. The Scope 3 Standard was published in 2011, at the same time as the Product Life Cycle Standard.

Currently, the Scope 3 Standard is being updated to reflect important developments in greenhouse gas accounting and reporting since its publication. Read more on that process here.

For more information and further reading:

26. How does the GHG Protocol describe influence and its role in prioritizing scope 3 emissions reporting?

Influence is a key criterion for identifying relevant scope 3 activities for which “there are potential emissions reductions that could be undertaken or influenced by... [a reporting] company” (Scope 3 Standard, p. 61).

Scope 3 emissions are indirect emissions that are a consequence of the activities of a reporting company but occur from sources owned and controlled by other entities in the value chain (e.g., contract manufacturers, materials suppliers, third-party logistics providers, waste management suppliers, travel suppliers, lessees and/or lessors, franchisees, retailers, employees, and customers).

Each entity in the value chain has some degree of influence over emissions and reductions. Reporting companies can influence scope 3 emissions reductions upstream and downstream of their operations, for example, by purchasing lower-carbon products or designing less energy-intensive sold products. Companies should prioritize activities in the value chain where the reporting company has the potential to influence GHG reductions. Refer to Table 9.7 (p. 110-111) for illustrative examples of actions to influence scope 3 reductions in the Scope 3 Standard. Refer to Box 6.2 for an explanation of influence (Scope 3 Standard, p. 61).

For more information and further reading:

- Scope 3 Standard, Chapter 6 (Setting the Scope 3 Boundary); Box 6.2 (Influence), p. 61; Table 9.7 (Illustrative examples of actions to reduce scope 3 emissions), p. 110-111

27. Where can I find reliable sources for scope 3 emission factors?

The GHG Protocol provides a list of calculation tools that includes emission factors from reliable sources on Greenhouse Gas Protocol Tools and Resources website, which includes:

- The Cross-sector Emission Factors Tool contains cross-sector emission factors and unit conversions that can be used to estimate emissions from stationary combustion, purchased electricity (location-based emission factors for 6 countries), and mobile combustion.

- The GHG Emissions from Transport or Mobile Sources is applicable to the calculation of Scope 3 categories 4 (Upstream Transportation and Distribution), 6 (Business Travel), 7 (Employee Commuting), and 9 (Downstream Transportation and Distribution).

- The GHG Protocol also provides a non-exhaustive list of third-party life cycle databases on its website. The inclusion of a database in this list does not constitute an endorsement by the GHG Protocol.

- Some of the data in these sources may not be consistent with certain GHG Protocol standards. Before using a database, its documentation should be reviewed for transparency, completeness, and applicability to the GHG inventory for which the data is being collected. For example, a database may contain combustion-only emission factors that are not applicable to product life cycle GHG inventories. Data should also be evaluated using the data quality indicators described in the Scope 3 Standard (Chapter 7, p. 76) and the Product Standard (Chapter 8, p. 55) and selecting the highest quality data available in the context of business objectives and the principles of relevance, completeness, consistency, transparency, and accuracy.

Other sources include:

- DEFRA Carbon Emissions Conversation Factors: The UK government provides an annual set of conversion factors, which include factors for various sectors and activities.

- Environmentally Extended Input-Output (EEIO) Models: These models are used to derive spend-based emission factors, and some databases provide specific factors by industry or product category.

- The U.S. EPA GHG Emission Factors Hub was designed to provide organizations with a regularly updated and easy-to-use set of default emission factors for organizational greenhouse gas reporting. The EPA EF Hub includes datasets comprised of greenhouse gas (GHG) emission factors (Factors) for 1,016 U.S. commodities as defined by the 2017 version of the North American Industry Classification System (NAICS). The Factors are based on GHG data representing 2019.

28. Can scope 2 market-based emissions data be applied to a scope 3 inventory?

The Scope 3 Standard (2011) does not provide guidance concerning scope 2 location- or market-based accounting within scope 3. The requirements introduced in the Scope 2 Guidance (2015) act as an amendment to the Corporate Standard.

The current update process of the suite of GHG Protocol corporate standards and guidance will provide clarity on the use of value chain partners’ emissions data calculated using the scope 2 location-based and market-based methods in a scope 3 inventory.

You can read more about the revision process and follow the updates on our website.

In the absence of guidance, companies may wish to consult with their auditors and consider rules provided by relevant target-setting programs or applicable regulatory schemes in their jurisdiction(s) on how to report these instruments in their reports, while ensuring full transparency and following all GHG accounting and reporting principles.

29. How is the project-based accounting method applied in scope 3 reporting?

The project-based method is different and separate from the inventory method (see FAQ 32: What is the difference between inventory and project-based accounting?). While the inventory method accounts for scope 3 emissions associated with a company’s value chain, the project-based method allows companies to separately quantify consequential assessments of GHG impacts of specific projects or actions taken within their value chain.

According to Section 9.4 of the Scope 3 Standard (p. 106-107), companies may use the project-based method to undertake more detailed assessments of GHG reductions from discrete scope 3 GHG mitigation projects (such as those listed in table 9.7), in addition to reporting comprehensive scope 3 GHG emissions using the inventory method. Any project-based reductions must be reported separately from the company’s scope 1, scope 2, and scope 3 emissions. For more information on quantifying project-based GHG reductions, refer to the GHG Protocol for Project Accounting.

For more information and further reading:

- Scope 3 Standard, Section 9.4, p. 106-107

- Project Protocol

- “Inventory and Project Accounting: A Comparative Review,” GHG Protocol

30. What is the difference between inventory and project-based accounting?

Inventory accounting, also known as attributional accounting, tracks GHG emissions and removals within a defined organizational and operational boundary over time. It is the primary method used by corporations and other organizations to report emissions from their operations and value chains.

Project-based accounting, also known as consequential accounting or intervention accounting, estimates the impacts or changes in GHG emissions resulting from specific projects, actions, or interventions relative to a counterfactual baseline scenario. It is the primary method used to evaluate the emission effects of projects by comparing emissions and removals that happen in the project scenario with an estimate of what would have happened without the intervention. The project-based accounting approach evaluates system-wide emissions impacts of the project or intervention in question, without regard to the reporting company’s operational or organizational inventory boundary.

Table 9.6 of the Scope 3 Standard (p. 107), copied below, details both approaches to account for GHG reductions.

Methods for accounting for GHG reductions

| Method | Description | Relevant GHG Protocol Publication |

| Inventory method | Accounts for GHG reductions by comparing changes in the company’s actual emissions inventory over time relative to a base year | GHG Protocol Corporate Standard GHG Protocol Scope 3 Standard |

| Project method | Accounts for GHG reductions by quantifying impacts from individual GHG mitigation projects relative to a baseline (i.e., a hypothetical scenario of what emissions would have been in the absence of the project) | GHG Protocol for Project Accounting |

Source: Scope 3 Standard, Table [9.6] Methods for accounting for GHG reductions, p. 107

For a more detailed review of these accounting methods, read GHG Protocol's “Inventory and Project Accounting: A Comparative Review."

For more information and further reading:

- “Inventory and Project Accounting: A Comparative Review,” GHG Protocol

- Scope 3 Standard, Table 9.6, p. 107

31. How should avoided emissions from the use of sold products be accounted for?

The Scope 3 Standard does not “address the quantification of avoided emissions or GHG reductions from actions taken to compensate or offset emissions” (p. 7). The Scope 3 Standard is designed to support quantifying and reporting scope 3 reductions determined by comparing year-over-year changes in companies’ scope 3 category emissions, relative to a base year.

In some cases, GHG reduction opportunities lie beyond a company’s scope 1, 2, and 3 inventories. For example, some companies may track emissions from the use of their products (Category 11) and also measure the avoided emissions that result when their products offer a lower-emission alternative to other solutions. Avoided emissions may also arise, for example, when accounting for emissions from recycling (category 5 or 13).