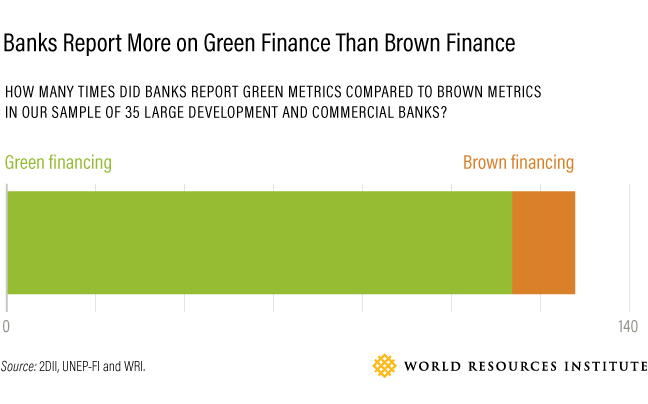

The World Is Counting on Banks to Deliver Climate Finance. Counting Their Progress Is No Easy Feat.

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is increasingly aware of the need to shift capital flows away from companies and activities that contribute to the climate problem and into climate solutions.

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is increasingly aware of the need to shift capital flows away from companies and activities that contribute to the climate problem and into climate solutions.