Seeking Participation in the Beta Test of a New GHGP Cross-Sector Corporate Calculation Tool

New excel-based tool from Greenhouse Gas Protocol and WRI that helps companies estimate their greenhouse gas (GHG) emissions based on the GHG Protocol.

New excel-based tool from Greenhouse Gas Protocol and WRI that helps companies estimate their greenhouse gas (GHG) emissions based on the GHG Protocol.

For many businesses, value chain (scope 3) emissions account for more than 70 percent of their carbon footprint. Measuring and managing these emissions can motivate a company to do business with greener suppliers, improve the energy efficiency of its products, and rethink its distribution network -- measures that significantly reduce the overall impact on the climate.

There is considerable interest among companies in claiming that their products can help avoid greenhouse gas emissions compared to other products in the marketplace. While it’s true that the use of some products can help to avoid GHG emissions, accurately measuring a product’s impact—whether positive or negative—can be challenging.

This paper outlines a neutral framework for estimating and disclosing both positive and negative impacts of products and provides recommendations for companies to improve the credibility and consistency of their claims.

Cold-water laundry detergents, fuel-saving tires, energy-efficient ball bearings, emissions-saving data centers. Corporations are increasingly claiming that their goods and services reduce emissions. But there is a big problem: These avoided emissions claims are often unverifiable or inaccurate.

Join us March 20-22 in Baltimore to connect with the nation’s thought leaders and decision-makers at the 8th annual Climate Leadership Conference. WRI is co-hosting Scaling Collective Action: Best Practices for Setting and Achieving SBTs in the Value Chain workshop on Wednesday, March 20th from 9:00 – 10:30 am.

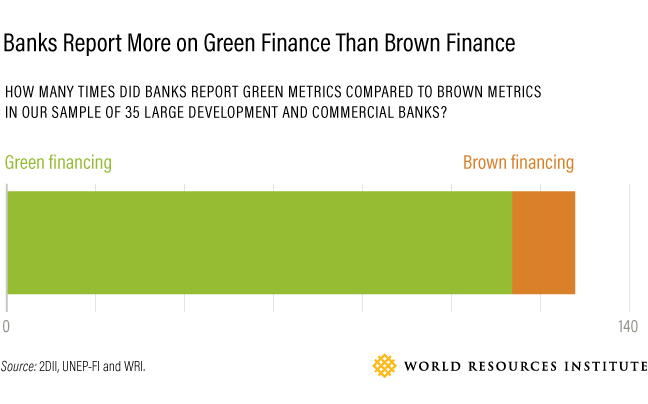

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is increasingly aware of the need to shift capital flows away from companies and activities that contribute to the climate problem and into climate solutions.

Banks are connected to every part of the economy through their investing and lending activities. That means they play a crucial role in financing the transition to a low-carbon economy. The financial sector is increasingly aware of the need to shift capital flows away from companies and activities that contribute to the climate problem and into climate solutions.